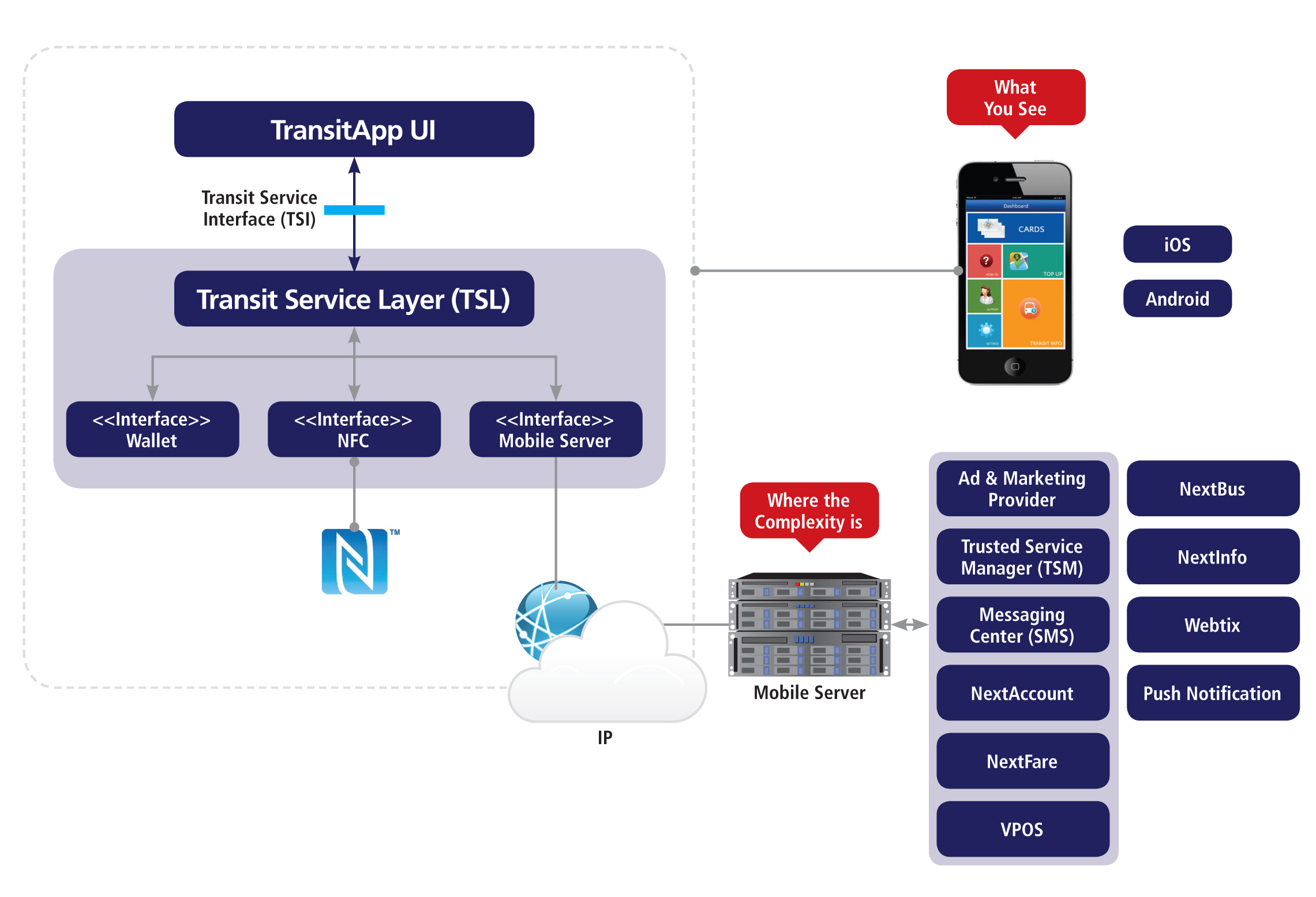

Cubic NextWave components

Cubic latest introduction provides a short cut for transit authorities looking to offer travellers mobile, Smart phone payment options.

Transit operators wanting to provide travellers with a mobile fare payment option now have an ‘off-the-shelf’ solution in378 Cubic’s NextWave. Through the use of near field communications (NFC) technology, NextWave turns travellers’ mobile phones and tablets into the equivalent of a ticket vending machine able to instantly re-load contactless transit cards. It also enables the smart phone or tablet to be used as a contactless NFC fare card.

According to Cubic, NextWave simplifies transit operators’ deployment of mobile services by providing a cloud-based platform that integrates closed- and open-loop contactless fare systems, payment processors, mobile networks and NFC platforms. The system is suitable for iOS and1812 Android smart phones and tablets. Transit operators using NextWave get a branded mobile app and can offer cloud-based support services to send out alerts about any travel disruption and help travellers with journey planning.

Where the existing ticket barriers or on-board readers already accept plastic contactless payment cards, the reader will require remotely downloadable firmware updates to recognise NFC transit cards. Back end changes are also required to provide a secure gateway between the transit operator’s back office system and mobile phone NFC infrastructure in order to manage a transit card in the smart phone’s secure element. With the introduction of NextWave, Cubic says it has a mobile gateway which overcomes this complexity and provides transit agencies with a one-stop solution.

Transit operators tend to use one of two fare architectures - either card based or account based. David deKozan, Cubic’s vice president for strategic initiatives, says: “In both cases, the user can pay for their travel through the mobile application with an e-commerce transaction to transfer the funds. Once the transit operator receives payment, either an ‘electronic ticket’ is sent to the smart phone or the individual’s account is credited with the funds.”

Travellers register their contactless smart card (either physical or NFC smart phone) with NextWave and nominate a payment mechanism which can include credit card, a bank-issued contactless card, direct debit or a ‘cloud wallet’ such as PayPal. Payment setting can either be pre-configured in the account or on a per transaction basis.

“When travellers pay using the contactless system, the settlement is identical to transactions at ticket vending machines with funds being settled that night,” deKozan says.

All types of fare (closed loop stored value, time based passes, ride books and pre-tax benefit pools) can be purchased via the NextWave app. If the transit operator support bank issued contactless payment cards, then transactions can be processed on a Pay as You Go basis whether such transactions come from plastic cards or reside in a mobile wallet.

“The system is designed to support the transit operator’s current fare processing rules on mobile devices. So for those using card based systems, the mobile device can manage and load the contactless smart card or allow a virtual NFC card to be stored in the phone’s secure element. Travellers can load their card with the product of choice or in a contactless payment enabled system, perform PAYG transactions,” deKozan says.

Downloading the app and registering an existing card will typically take less than three minutes and once the app is set up and the payment source configured, Cubic says purchasing an individual fare can be performed in less than 20 seconds.

According to deKozan, meet fulfil PCI regulations most transit systems require the reader and card to perform a secure three pass authentication before the card details can be read. Personal information is not transferred at the point of use and the data passing between the card and the reader is encrypted to prevent interception by another person or system. The same principles apply to the NFC transit card which reside in a phone’s secure element and is protected by the same cryptography and security used for credit and debit cards. Cubic says the NFC transit card cannot be accessed or modified by unauthorised applications or hackers.

Cubic has taken into account the potential of the phone’s battery dying while the traveller is in transit. It has performed a variety of tests which show the NFC transit card can perform several thousand contactless transactions (such as tapping the phone on the turnstile or bus reader) even if the battery has insufficient energy to power the phone and display.

“This allows time for the traveller to reach their destination and recharge their phone,” notes deKozan.

Discussion with transit authorities to date have centred on preserving existing fare policies and allowing the same schemes to be offered via contactless smart cards. However, deKozan says: “The underlying fare systems are configurable and could be set up to deal with new policies and a new fare classes.”

Transit operators wanting to provide travellers with a mobile fare payment option now have an ‘off-the-shelf’ solution in

According to Cubic, NextWave simplifies transit operators’ deployment of mobile services by providing a cloud-based platform that integrates closed- and open-loop contactless fare systems, payment processors, mobile networks and NFC platforms. The system is suitable for iOS and

Where the existing ticket barriers or on-board readers already accept plastic contactless payment cards, the reader will require remotely downloadable firmware updates to recognise NFC transit cards. Back end changes are also required to provide a secure gateway between the transit operator’s back office system and mobile phone NFC infrastructure in order to manage a transit card in the smart phone’s secure element. With the introduction of NextWave, Cubic says it has a mobile gateway which overcomes this complexity and provides transit agencies with a one-stop solution.

Transit operators tend to use one of two fare architectures - either card based or account based. David deKozan, Cubic’s vice president for strategic initiatives, says: “In both cases, the user can pay for their travel through the mobile application with an e-commerce transaction to transfer the funds. Once the transit operator receives payment, either an ‘electronic ticket’ is sent to the smart phone or the individual’s account is credited with the funds.”

Travellers register their contactless smart card (either physical or NFC smart phone) with NextWave and nominate a payment mechanism which can include credit card, a bank-issued contactless card, direct debit or a ‘cloud wallet’ such as PayPal. Payment setting can either be pre-configured in the account or on a per transaction basis.

“When travellers pay using the contactless system, the settlement is identical to transactions at ticket vending machines with funds being settled that night,” deKozan says.

All types of fare (closed loop stored value, time based passes, ride books and pre-tax benefit pools) can be purchased via the NextWave app. If the transit operator support bank issued contactless payment cards, then transactions can be processed on a Pay as You Go basis whether such transactions come from plastic cards or reside in a mobile wallet.

“The system is designed to support the transit operator’s current fare processing rules on mobile devices. So for those using card based systems, the mobile device can manage and load the contactless smart card or allow a virtual NFC card to be stored in the phone’s secure element. Travellers can load their card with the product of choice or in a contactless payment enabled system, perform PAYG transactions,” deKozan says.

Downloading the app and registering an existing card will typically take less than three minutes and once the app is set up and the payment source configured, Cubic says purchasing an individual fare can be performed in less than 20 seconds.

According to deKozan, meet fulfil PCI regulations most transit systems require the reader and card to perform a secure three pass authentication before the card details can be read. Personal information is not transferred at the point of use and the data passing between the card and the reader is encrypted to prevent interception by another person or system. The same principles apply to the NFC transit card which reside in a phone’s secure element and is protected by the same cryptography and security used for credit and debit cards. Cubic says the NFC transit card cannot be accessed or modified by unauthorised applications or hackers.

Cubic has taken into account the potential of the phone’s battery dying while the traveller is in transit. It has performed a variety of tests which show the NFC transit card can perform several thousand contactless transactions (such as tapping the phone on the turnstile or bus reader) even if the battery has insufficient energy to power the phone and display.

“This allows time for the traveller to reach their destination and recharge their phone,” notes deKozan.

Discussion with transit authorities to date have centred on preserving existing fare policies and allowing the same schemes to be offered via contactless smart cards. However, deKozan says: “The underlying fare systems are configurable and could be set up to deal with new policies and a new fare classes.”