Oregon’s RUC system uses a dongle to track mileage driven

Eric G. O’Rear and Wallace E. Tyner look at the benefits of mileage charges and how these might be implemented.

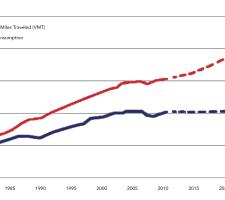

Since the early 1900s, taxes on petrol (gasoline) and diesel fuels have been used to finance the construction and maintenance of roadway infrastructure and, in some countries other government spending too. Now, a combination of improved fuel economy, the advent of hybrid and alternative fuelled vehicles and a reluctance in some countries (especially the US) to increase fuel taxes has led to a dramatic fall in revenue to governments and road authorities.

In the US, the national average gasoline and diesel tax rates has not increased since 1993. The Tax Policy Center found that if the gasoline tax had been indexed to inflation, tax rates would be higher in 41 states and the District of Columbia. In 2013, that additional revenue would have topped $100 million in 24 US states.

While easy to administer, one drawback of fuel duty is that the improvements in the fuel economy of new passenger vehicles not only erodes tax revenue, it is also regressive by penalising those unable to afford newer vehicles. For all these reasons policymakers are considering tax system changes or the use of alternative mechanisms to create more revenue.

A major bene_ t of a VMT tax system is its flexibility: rate structures can vary according to vehicle class, type and weight and their environmental friendliness. Low emission vehicles could have lower per-km charges while still allowing the owners of electric vehicles to contribute something to the upkeep of the roads they are using.

In moving from a fuel tax which has an indirect (and reducing) influence on how much people drive, to a VMT charge based directly on the distance each vehicle travels, this may lead to a reduction in total vehicle miles driven. This could occur by making ride sharing more attractive and mitigate against making discretionary journeys by car and thereby reduce congestion, road crashes, casualties and discomfort from air and noise pollution.

There are considerable differences between the options in terms of costs, privacy, implementation and operational challenges.

For example, self-reported odometer readings and an in-vehicle GPS system can both track miles driven by a single vehicle. However, GPS is more costly and likely to incite privacy concerns as many motorists fear system like OBUs or GPS which can collect locational or driving behaviour data pose a risk to their private information.

To implement such options, compliance measures and national regulations are needed to ensure privacy is protected. Successful VMT tax application will be largely dependent upon how well the authorities can overcome the many challenges surrounding program design and implementation.

There is a body of evidence showing the relationship between vehicle weight and roadway damage with that inflicted by large trucks and buses being an order of magnitude greater than that caused by light-duty vehicles. In many countries the amount large vehicle owners currently pay in fuel taxes does not reflect that difference – effectively the car drivers are subsidising the truckers which has prompted the likes of Germany to introduce mileage-based tax on vehicles over 12tonnes using its autobahns.

Transitioning from fuel duties to distance travelled taxes also allows differentiation of vehicle classes using per-km price variation to hold their owners accountable for their relative contributions to road wear. To illustrate how a national weight-based VMT tax rate may be computed and implemented, it is easiest to consider a simple flat-rate tax formulation.

If policymakers’ goal is a cost-neutral way of switching from existing volumetric taxes to an equivalent VMT charge, this requires converting existing fuel tax rates to equivalent per-mile charge. To calculate the baseline fuel tax to an equivalent VMT charge, a basic conversion formula takes the current national average tax rate ($/litre) and divides it by the average fuel economy (km/litre) for a given vehicle class.

For example, in the US the VMT tax rate for a gasoline-powered sub-compact car would be derived by dividing the gas tax rate by the average sub-compact vehicle fuel economy. The resulting calculation means the charge per km driven is equivalent to the charge per litre consumed.Decisions on how to reflect the vehicle-type classification and weight category in the VMT pricing scheme will depend on the number of vehicle categories and how roadway damage costs are distributed.

The US Federal Highway Administration (FHWA) has 13 vehicle categories based on type and/or number of axles meaning that road wear costs can be fairly distributed across all possible vehicle types. In roadway and pavement design, Equivalent Single Axle Loads (ESALs) are used to relate roadway damage to vehicle axle load and allow comparison of axle effects across the various vehicle types. Light-duty or mid-size vehicles have lower average ESAL values than heavy-duty vehicles such as trucks and buses and therefore inflict less roadway damage per pass than a heavy vehicle while still having a greater impact than lighter vehicles.

ESAL values are calculated using one of two equations (one for flexible pavements and one for rigid pavements) and axle effects can only be compared for like pavement types.

To incorporate price variations, first information about the average ESAL values for each of the 13 US FHWA vehicle classifications is required. Then a vehicle type category is identified as the numeraire and given a damage factor of 1. Computing the damage factor for all remaining vehicle classifications is done by dividing the average ESAL for the numeraire by the average ESAL value for each of the other vehicle classes. Because ESAL values vary by road type, so will the damage factor. The resulting VMT rate for vehicle type classification i and road type j, is computed by multiplying the baseline VMT rate by its corresponding damage factor (DMFij).

Compared to a single VMT charge, application of VMT rates varying by road type are very complicated and require an in-vehicle GPS system. However, a single per-mile charge can be computed for each vehicle class by using a weighted-average of the pavement type-specific VMT tax rates (VMT Tax Rateij). Annual reported traffic data can be used to make valid assumptions regarding the fraction or percentage of travel by each vehicle class on each road type. Given the two primary pavement types (flexible and rigid) the new weighted VMT tax formulation for vehicle type classification can be seen below.

The flexibility of a VMT tax structure of this sort allows rates to be adjusted such that they are revenue-neutral (generates similar revenue levels as fuel taxes) or revenue enhancing. Whatever the outcome, it is clear that defining tax rates by vehicle class can do a better job of matching road damage inflicted to the tax paid than a simple fuel tax.

Another variable is the costs associated with implementing and administering VMT tax structures, as these can vary depending on the tax function. The same can be said about the tax’s effectiveness.

The two tax formulations above are simplistic but illustrate how flexible a VMT tax structure can be and some countries are already discovering this in practical terms. It is unlikely that the US will begin implementing VMT taxes at the national level before and until the pilot studies prove that successful implementation occurs at both the local and state levels.

One factor, however, remains constant and that is how readily the public accept a VMT tax will largely depend on how well policymakers present the benefits of the alternative tax system and alleviate concerns over privacy implementation and costs.

Furthermore, a VMT tax will also fail in the longer term if politicians are unwilling to adjust the per-km charge to reflect changes in construction and maintenance costs.

ABOUT THE AUTHORS:

Eric G. O’Rear (left) is an economics graduate of Purdue University and his research interests include transportation economics, environmental policy, building energy efficiency and building economics.

Wallace E. Tyner is a Professor of Agricultural Economics at Purdue University, researching energy technology and policy issues.

Since the early 1900s, taxes on petrol (gasoline) and diesel fuels have been used to finance the construction and maintenance of roadway infrastructure and, in some countries other government spending too. Now, a combination of improved fuel economy, the advent of hybrid and alternative fuelled vehicles and a reluctance in some countries (especially the US) to increase fuel taxes has led to a dramatic fall in revenue to governments and road authorities.

In the US, the national average gasoline and diesel tax rates has not increased since 1993. The Tax Policy Center found that if the gasoline tax had been indexed to inflation, tax rates would be higher in 41 states and the District of Columbia. In 2013, that additional revenue would have topped $100 million in 24 US states.

While easy to administer, one drawback of fuel duty is that the improvements in the fuel economy of new passenger vehicles not only erodes tax revenue, it is also regressive by penalising those unable to afford newer vehicles. For all these reasons policymakers are considering tax system changes or the use of alternative mechanisms to create more revenue.

A better solution?

Indexing fuel tax rates to the Consumer Price Index or inflation could ease the problem but can be difficult to achieve given the anti-tax sentiment of many policymakers. And with the link between fuel consumption and road use now compromised (and in some cases severed) policymakers are considering moving from a fuel tax to a charge based on vehicle miles travelled (VMT). In the US the National Surface Transportation Infrastructure Finance Commission (NSTIFC) believes a VMT tax will not only generate more sustainable streams of revenue, but it will also lead to more efficient use of roadways. In 2015, the state of Oregon launched a test mileage fee program open to 5,000 vehicle owners, where program volunteers pay a charge of 0.9¢/km.A major bene_ t of a VMT tax system is its flexibility: rate structures can vary according to vehicle class, type and weight and their environmental friendliness. Low emission vehicles could have lower per-km charges while still allowing the owners of electric vehicles to contribute something to the upkeep of the roads they are using.

In moving from a fuel tax which has an indirect (and reducing) influence on how much people drive, to a VMT charge based directly on the distance each vehicle travels, this may lead to a reduction in total vehicle miles driven. This could occur by making ride sharing more attractive and mitigate against making discretionary journeys by car and thereby reduce congestion, road crashes, casualties and discomfort from air and noise pollution.

Design and implementation

Concerns over how to implement a VMT tax, selecting the correct technical design to support the tax, high administration costs and privacy continue to impede its adoption in the US and other countries. The first step in implementation is defining the functions of the tax before considering the technical design capable of supporting the system. Options include annual self-reported odometer readings, yearly odometer checks by official inspectors, use of fuel consumption-based estimates, installation of an onboard unit (OBU) as a metering device, or an in-vehicle global positioning system (GPS).There are considerable differences between the options in terms of costs, privacy, implementation and operational challenges.

For example, self-reported odometer readings and an in-vehicle GPS system can both track miles driven by a single vehicle. However, GPS is more costly and likely to incite privacy concerns as many motorists fear system like OBUs or GPS which can collect locational or driving behaviour data pose a risk to their private information.

To implement such options, compliance measures and national regulations are needed to ensure privacy is protected. Successful VMT tax application will be largely dependent upon how well the authorities can overcome the many challenges surrounding program design and implementation.

Tax rates

Toll roads and increased vehicle registration fees have provided additional financing for highway maintenance and construction. However, these benefits remain at the local level - the application of a national VMT tax would overcome that problem. Advocates of VMT tax primarily support the mechanism being used to finance roadway maintenance and construction projects.There is a body of evidence showing the relationship between vehicle weight and roadway damage with that inflicted by large trucks and buses being an order of magnitude greater than that caused by light-duty vehicles. In many countries the amount large vehicle owners currently pay in fuel taxes does not reflect that difference – effectively the car drivers are subsidising the truckers which has prompted the likes of Germany to introduce mileage-based tax on vehicles over 12tonnes using its autobahns.

Transitioning from fuel duties to distance travelled taxes also allows differentiation of vehicle classes using per-km price variation to hold their owners accountable for their relative contributions to road wear. To illustrate how a national weight-based VMT tax rate may be computed and implemented, it is easiest to consider a simple flat-rate tax formulation.

If policymakers’ goal is a cost-neutral way of switching from existing volumetric taxes to an equivalent VMT charge, this requires converting existing fuel tax rates to equivalent per-mile charge. To calculate the baseline fuel tax to an equivalent VMT charge, a basic conversion formula takes the current national average tax rate ($/litre) and divides it by the average fuel economy (km/litre) for a given vehicle class.

For example, in the US the VMT tax rate for a gasoline-powered sub-compact car would be derived by dividing the gas tax rate by the average sub-compact vehicle fuel economy. The resulting calculation means the charge per km driven is equivalent to the charge per litre consumed.Decisions on how to reflect the vehicle-type classification and weight category in the VMT pricing scheme will depend on the number of vehicle categories and how roadway damage costs are distributed.

The US Federal Highway Administration (FHWA) has 13 vehicle categories based on type and/or number of axles meaning that road wear costs can be fairly distributed across all possible vehicle types. In roadway and pavement design, Equivalent Single Axle Loads (ESALs) are used to relate roadway damage to vehicle axle load and allow comparison of axle effects across the various vehicle types. Light-duty or mid-size vehicles have lower average ESAL values than heavy-duty vehicles such as trucks and buses and therefore inflict less roadway damage per pass than a heavy vehicle while still having a greater impact than lighter vehicles.

ESAL values are calculated using one of two equations (one for flexible pavements and one for rigid pavements) and axle effects can only be compared for like pavement types.

To incorporate price variations, first information about the average ESAL values for each of the 13 US FHWA vehicle classifications is required. Then a vehicle type category is identified as the numeraire and given a damage factor of 1. Computing the damage factor for all remaining vehicle classifications is done by dividing the average ESAL for the numeraire by the average ESAL value for each of the other vehicle classes. Because ESAL values vary by road type, so will the damage factor. The resulting VMT rate for vehicle type classification i and road type j, is computed by multiplying the baseline VMT rate by its corresponding damage factor (DMFij).

Compared to a single VMT charge, application of VMT rates varying by road type are very complicated and require an in-vehicle GPS system. However, a single per-mile charge can be computed for each vehicle class by using a weighted-average of the pavement type-specific VMT tax rates (VMT Tax Rateij). Annual reported traffic data can be used to make valid assumptions regarding the fraction or percentage of travel by each vehicle class on each road type. Given the two primary pavement types (flexible and rigid) the new weighted VMT tax formulation for vehicle type classification can be seen below.

The flexibility of a VMT tax structure of this sort allows rates to be adjusted such that they are revenue-neutral (generates similar revenue levels as fuel taxes) or revenue enhancing. Whatever the outcome, it is clear that defining tax rates by vehicle class can do a better job of matching road damage inflicted to the tax paid than a simple fuel tax.

Another variable is the costs associated with implementing and administering VMT tax structures, as these can vary depending on the tax function. The same can be said about the tax’s effectiveness.

The two tax formulations above are simplistic but illustrate how flexible a VMT tax structure can be and some countries are already discovering this in practical terms. It is unlikely that the US will begin implementing VMT taxes at the national level before and until the pilot studies prove that successful implementation occurs at both the local and state levels.

One factor, however, remains constant and that is how readily the public accept a VMT tax will largely depend on how well policymakers present the benefits of the alternative tax system and alleviate concerns over privacy implementation and costs.

Furthermore, a VMT tax will also fail in the longer term if politicians are unwilling to adjust the per-km charge to reflect changes in construction and maintenance costs.

ABOUT THE AUTHORS:

Eric G. O’Rear (left) is an economics graduate of Purdue University and his research interests include transportation economics, environmental policy, building energy efficiency and building economics.

Wallace E. Tyner is a Professor of Agricultural Economics at Purdue University, researching energy technology and policy issues.