Smart parking looks like a market poised to take off in the US.

New initiatives in smart parking have been announced in the US and Europe in recent months. Is the age of smarter parking finally with us? Jon Masters investigates.

Smart parking comes to Manchester, reads the headline to a story posted on the UK city’s website towards the end of March this year. Sensors will be fixed to parking spaces to give drivers and authorities information on parking availability via mobile phone apps and other software, the story goes on to explain.Lower down the page, Manchester City Council’s text incorrectly says the city is introducing the first major trial of this technology in the UK. Birmingham in the West Midlands already has a larger smart parking pilot scheme under way, piloting equipment and software from three different firms. Initiation of the Birmingham trial followed on the heels of another in Westminster in London.

A lack of awareness in Manchester is symptomatic of a general public ignorance of parking services, a problem which may soon be overcome, but more on that later.

The tone of the city council’s announcement reflects a sense of pride in its technological progress and rightly so. There are not many cities in the UK introducing smart parking initiatives and only a handful are doing the same across Europe. It is in the United States where smart parking has been pioneered and become more widespread. A leading supplier is

Streetline is also the company working with Manchester City Council; it is one of the three trialists in Birmingham; and the firm has partnered with

Principal aims

The technology and systems on offer have a number of facets. The sensors alone come in a variety of forms but the majority of schemes follow the same essential principles of gathering and disseminating real-time information to guide drivers to unoccupied spaces more quickly and to supply city authorities with valuable data on parking use and availability. With this information comes the possibility of varying the price of parking in accordance with demand in different locations or times of day, as municipal authorities in Los Angeles and San Francisco have done in the US.Reducing traffic congestion is a principal aim. A statistic often used by advocates of smart parking, resulting from a series of studies in the US, has it that of all town and city centre traffic at any one time, an average of 30% is made up of drivers looking for a parking space.

In Birmingham, the principle of smart parking is being seen as offering a wide range of different opportunities. Leading the trial is the infrastructure services company Amey, which is maintaining all of Birmingham’s roads and street assets through a 30 year public private partnership with the city council.

“We are aiming to use the data from parking sensors in a number of different ways, exploring how it can benefit citizens and businesses,” says Amey’s regional business development director Mark Saunders.

“There is the aim of getting people parked quickly; congestion is a big problem for the city and its GDP, costing an estimated £2.3 billion (US$3.5 billion) annually. Plus, we are keen to work with technology suppliers to increase the visibility of parking availability for business. We have a sub-trial in development, aiming to help employees of a property agency reduce time lost looking for spaces when returning from viewing properties.

“There is a whole range of other possibilities. Every time we discuss the scope of the trial we come up with different ideas. I expect every city would have its own take on it,” says Saunders.

The Birmingham/Amey trial is piloting systems from a Streetline/

“Some spaces are over subscribed for demand, while others nearby are under used. A driver awareness problem has become apparent and we’re getting interesting conclusions on how long people stop at different times of the day, with information on more appropriate regimes of charging,” Saunders says.

Fulfilling potential

Varying prices to regulate demand would seem to represent smart parking developed to its full potential. In San Francisco, the SF Park project has been in place for two years now, with the objective of maintaining availability of one or two spaces at any location within SF Park sites at all times by regulating prices.The pilot scheme now applies to 8,200 metered kerb-side parking spaces and 12,250 bays of 15 city-owned parking facilities in seven areas of San Francisco. Charges are being regulated individually for every street and parking facility, in accordance with ‘demand elasticity’. This is a measure of how demand responds to fluctuation in price (defined as the percentage change in occupancy divided by change in meter price) and is calculated by studying parking availability before and after individual price changes.

Prices are only ever adjusted by +25 cents, -25 cents, or -50 cents an hour in San Francisco. They were first adjusted in August 2011, then again in October the same year and roughly every two months onwards to give a total of 5,294 demand elasticity values during the first year – six sets of price changes across three time periods for every street and parking facility of the seven pilot areas.

The upshot is that the San Francisco Municipal Transportation Authority is gradually evening out demand and it is building a lot of data and intelligence on pricing and its effects. The tenth set of price changes will be activated in April this year. Meter rates are set to decrease 25 or 50 cents for 22% of metered hours, stay the same for 58% and increase 25 cents during 20% of metered hours.

Professor Donald Shoup of the University of California in Los Angeles, a renowned expert and author on the subject, has acted as a special advisor to San Francisco for SF Park. His recent report on the latest findings from the project makes interesting reading. Results include wide disparity in demand elasticity across different locations, days of the week, times of day and time of year. It also varies between adjacent streets, mirroring what Amey is now discovering in Birmingham.

Overall, occupancy has risen in San Francisco. Parking revenues have increased, but only because the city has extended evening hours of charging and removed free parking on Sunday afternoons. Prices have fallen by 1% on average, which, says Donald Shoup, is the best rebuke to critics that would label SF Park a money grabbing exercise.

So what of the public reaction in San Francisco? This is something any elected council member will be keen to observe. “There has been almost no comment whatsoever,” says Shoup. “Many people in the city still do not realise it’s happening - that prices vary from place to place and on time of day. A lot of people don’t park in the same space every day and many parking in central districts are visitors from out of town so unlikely to notice much change or be aware that lower parking prices are available a short distance away.”

Scant awareness

This lack of awareness is one of a number of shortcomings Shoup suggests should be addressed if variable pricing is to work to its full potential. San Francisco’s authorities have introduced a smartphone app for finding parking spaces and prices in real-time. It also displays prices and availability via maps on its website. SF Park received considerable local media coverage when it was launched with new meters that allow payment by coins, credit card and mobile phone, but Shoup still reports scant appreciation of the price variations.A groundswell of growing awareness may be on the horizon, however, if a recent development from traffic navigation specialist

The company’s new parking product has been enabled by its existing partnerships and a few new ones, including with the consumer electronics manufacturer Kenwood and the parking information suppliers ParkMe and Parkopedia. ParkMe can provide live data from 18,000 facilities in the US, while Parkopedia has access to real-time information from 42,000 parking sites in Europe.

This is just for off-street parking, but it is not inconceivable that Inrix’s partnerships could be extended to San Francisco, Birmingham, Manchester and others to link cars to sensors in street parking spaces – and receive useful information directly from city authorities.

What Inrix is doing is likely to ripple out. Kenwood will be the first to introduce Inrix Parking to dashboard equipment. According to Inrix’s director for community relations Jim Bak, a deal has been signed with two vehicle manufacturers to introduce the parking information service to their US and European models.

“And it is not just going to be available in new cars. Any owner of a vehicle equipped with connected navigation technology will be offered the product as an update. Many manufacturers are now moving to this model of updates,” Bak says.

“During recent conversations with our customers, when asked what else they would like us to bring into vehicles, parking emerged as the biggest priority and it made natural sense to us as an extension of what we do. Navigation is usually to static points of interest. Inrix is now taking this further to include dynamic information on parking cost and availability, with navigation to the best available space.”

A step further

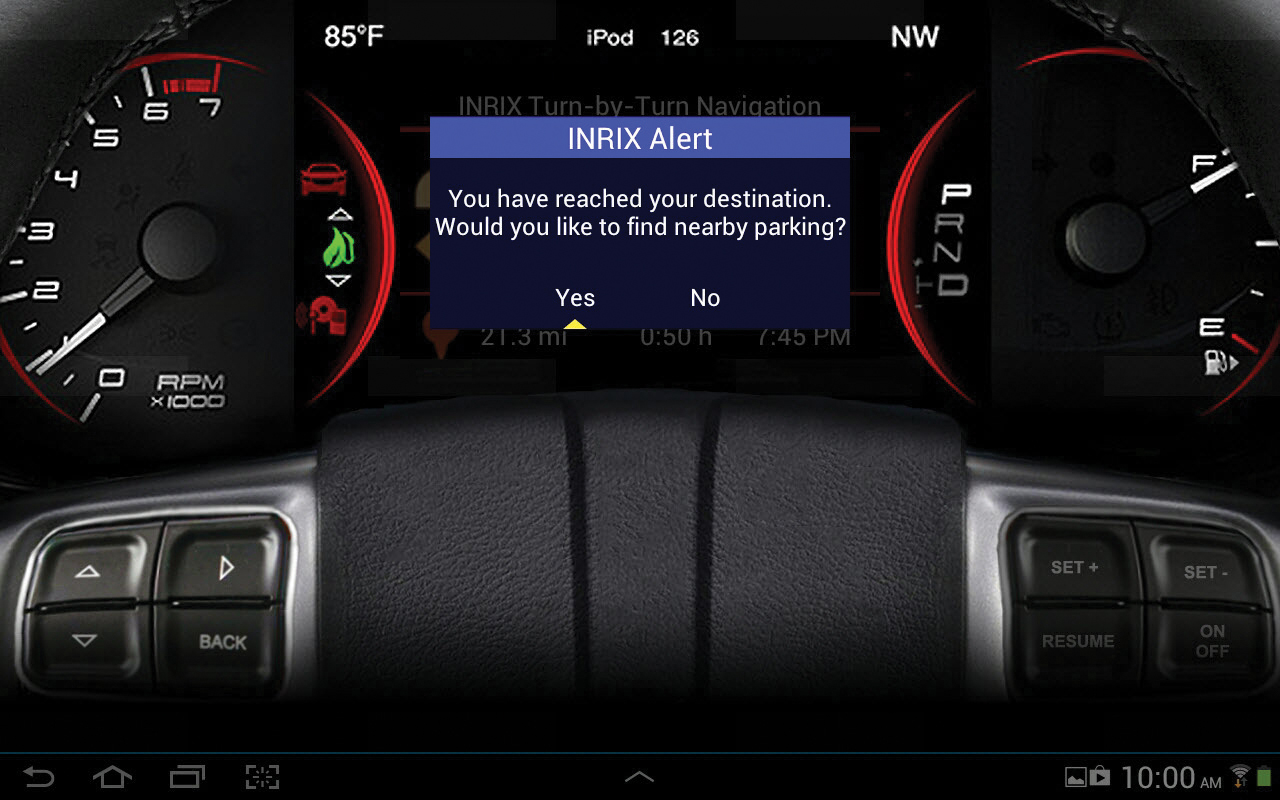

Inrix is exploring how it can take this innovation a step or two further, looking at ways that consumers could set preferences on the type of information they receive, Bak says. With vehicles connected to live data feeds comes the potential for parking firms to run promotions or deals such as cut-price parking at quiet times, or for consumers to rate or report parking services.There is also the important question of whether drivers should be directed to a parking facility most convenient for them or for the aims of local highway authorities. What is the ‘best’ available space? At present Inrix Parking will work as an overlay to normal navigation, interjecting to ask users if they want to find a parking facility as they near their chosen destination. The routing engine will then direct them to the site closest to that destination. A more effective service might include information from city authorities on traffic congestion and pricing.

“We are exploring opportunities with public parking suppliers,” says Bak. “We want to continue making the service more comprehensive, talking to academia as well on how we can make the service better.”

Academics in mind obviously include Donald Shoup, Bak says. Data such as that being gathered in San Francisco is likely to prove invaluable.

Outcomes there include the finding that many factors other than price affect parking occupancy in a given area; hence the conclusion that no formula can be given for setting prices correctly other than by adjusting them to achieve the desired level of occupancy.

Cost considerations

The costs of doing this will be an important factor for many authorities. Shoup dismisses the $20 million cost of SF Park as a relatively small investment. “It wouldn’t buy a single parking garage in San Francisco and it’s a lot cheaper than congestion charging,” he says.Nonetheless, the majority of SF Park funding has come from a grant from the US Department of Transportation’s Urban Partnerships Programme. “The question of who would pay for smart parking is an important one,” says Amey’s business development director Mark Saunders.

“It is unlikely that citizens would be willing to pay for it, but perhaps retailers would sponsor it. There are various models where the public or private sector could fund or subscribe. The private sector has a lot of interest in helping people to park quickly and influencing where they park.”

Furthermore, San Francisco’s SF Park has been heralded as a great success for the city so far, which may explain why Manchester City Council is so proud to announce its latest initiative in smart parking. “In San Francisco, politicians have been taking credit for new parking meters, which is incredible,” says Shoup. “They have achieved the double benefit of a better place to live and another feather in the cap for others to follow and I think they probably will.”